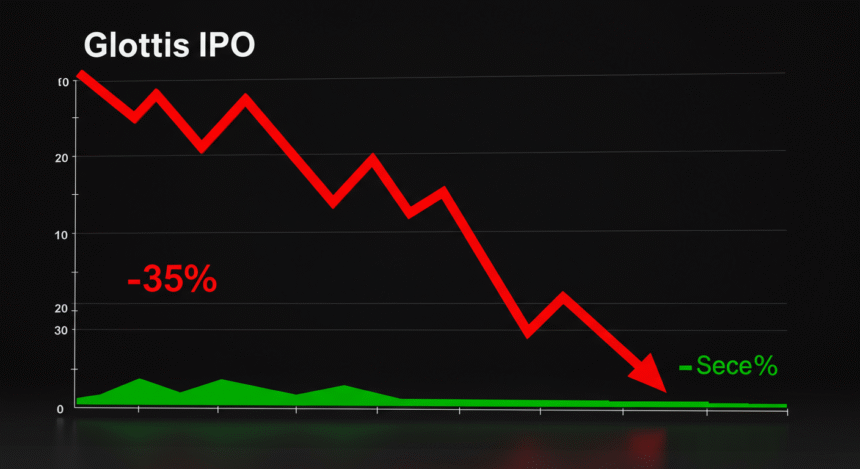

New Delhi: Logistics solutions company Glottis had a weak debut on the stock market today, with its shares listing at a steep 35% discount to the issue price. However, the stock showed signs of recovery after the initial slump.

Listing Performance

The shares began trading on the National Stock Exchange (NSE) at ₹83.85, a significant fall from the IPO issue price of ₹129 per share. This 35% discount disappointed investors who had put in bids for the initial public offering.

Despite the poor opening, the stock rebounded from its initial low. Post-listing, the share price recovered, providing some relief to investors.

IPO Subscription and GMP Signals

The tepid listing was anticipated by market observers, especially after the Grey Market Premium (GMP) for the IPO fell to zero ahead of the listing, signaling a likely discount.

The ₹307 crore IPO had received a lukewarm response from investors, subscribing only 2.12 times between September 29 and October 1.

- Retail Investors: 1.47 times

- Non-Institutional Investors (NII): 3.08 times

- Qualified Institutional Buyers (QIB): 1.84 times

The combination of a modest subscription and weak market sentiment is being seen as the primary reason for the company’s disappointing market debut.